Study Anything New From Gold Mutual Funds Currently? We Requested, You…

페이지 정보

본문

Investing in gold mutual funds and gold ETFs does not involve prices related to storage and insurance however does have management fees and bills that may affect your general funding returns. Gold prices tend to maneuver in the opposite direction of the general inventory market, while silver prices typically observe with the rise and fall of the stock market. Due to varied components, including altering market situations and/or laws the content could not be reflective of current opinions or positions. As an investment, gold performs greatest when situations are at their worst. And regardless of GLD's massive gold holdings, it remains to be vanishingly small compared to inventory-market capital. U.S. News: Despite the brief-time period correlation between equities and gold, some of the present strength in gold has been attributed to its safe-haven allure. KATE: Investors should treat gold, and valuable metals in general, like any other asset class in a diversified portfolio. Silver has extra industrial and commercial use than gold, however it does not offer as much portfolio diversification as gold. Gold IRA companies typically have partnerships with sellers and depositories to offer competitive charges and transparent pricing. In a self-directed IRA, you'll be able to hold gold bars or gold coins, but you'd need to arrange for storage, which some traders consider a greater problem than merely owning stocks of gold mining firms.

What Percentage of My Portfolio Should I Allocate to Gold? JULIE: An extended-held investment philosophy is that no single asset should dominate one's portfolio. Hence, a protected-haven asset is expected to retain its worth and even improve in value throughout times of market turbulence when most asset prices decline. No other asset within the history of the U.S. When it comes to choosing stocks, why is it hard to beat the market (indexes)? RITA: One of many most effective methods to invest in gold as a part of your IRA or brokerage account is through gold stocks, gold mutual funds or gold ETFs. These could be traded on main exchanges like stocks, offering a simple method to get publicity to gold. Also, many purists consider that gold's highest worth is that it's a hedge against major forms of economic disruption. A professional funding advisor will be invaluable because they will recommend a portfolio that will embrace gold's positive attributes, while avoiding an emotional overreaction by overweighting in treasured metals. Jewellery tends to be fragile and any harm will immediately devalue your funding.

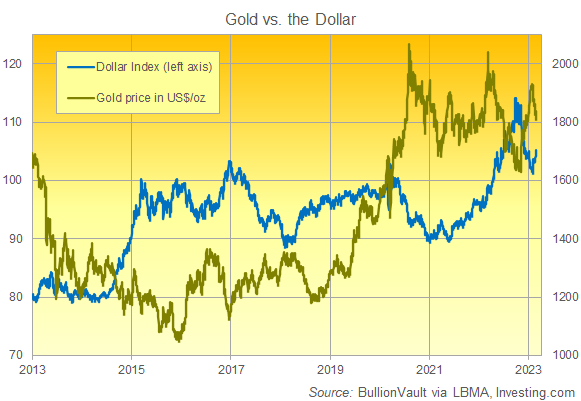

Real-time transparency is provided, guaranteeing that investors have access to accurate and up-to-date spot prices, facilitating effectively-informed trading and investment selections. Among the advantages embrace lower minimums, liquidity and access. The dollar is at present trading lower than its 2022 high. Global central banks boosted their gold purchases to more than 1,000 tons per year in both 2022 and 2023, with the buying dominated by emerging-market central banks, according to the World Gold Council. Fortunately, as gold has grow to be extra in style, many extra establishments have entered the gold IRA market, giving investors extra acceptable choices. KATE: While stocks are a proven hedge in opposition to inflation, gold may also play that role. KATE: Yes, you may invest in gold stocks in an IRA or a taxable brokerage account. RITA: Yes, one of the best ways to personal gold is through ETFs. RITA: Right, individuals invest in gold as a result of gold is a invaluable commodity. RITA: Diversification is one of the crucial fundamental rules of investing. Given the historic underperformance of gold miners in contrast with the price gold appreciation in usd gold price bullion, traders are usually higher off investing in gold immediately until they consider gold mining stocks are significantly undervalued. Investing in bodily gold comes with insurance premiums and the storage charges you mentioned.

There is a distinction between proudly owning gold and investing in gold. When individuals start their journey investing in treasured metals, gold is often the first thing they flip to. KATE: As the title suggests, a gold ETF tracks the price of gold. KATE: Other the explanation why gold can rise in tandem with stocks embrace worries about geopolitical uncertainties and interest charges, each of which are affecting investor sentiment in the mean time. Rise within the financial system leads to a considerable enhance in the worth of gold and silver. We can Clearly Observe that generally, the gold worth will rise during the Marriages Season (April to June) and Festive Seasons also. Also, artwork -- paintings, framed prints, or watercolors -- will ratchet up the tenor of any room and can be hung high enough so finger and nostril smudges will not be points. They can see it, touch it and have a general idea of how it would behave as an investment in these circumstances. Other than this, you should buy silver if you can not afford to buy gold. JULIE: Many gold enthusiasts still remember the 1970s, a trifecta of recession, double-digit inflation and soaring oil prices.

There is a distinction between proudly owning gold and investing in gold. When individuals start their journey investing in treasured metals, gold is often the first thing they flip to. KATE: As the title suggests, a gold ETF tracks the price of gold. KATE: Other the explanation why gold can rise in tandem with stocks embrace worries about geopolitical uncertainties and interest charges, each of which are affecting investor sentiment in the mean time. Rise within the financial system leads to a considerable enhance in the worth of gold and silver. We can Clearly Observe that generally, the gold worth will rise during the Marriages Season (April to June) and Festive Seasons also. Also, artwork -- paintings, framed prints, or watercolors -- will ratchet up the tenor of any room and can be hung high enough so finger and nostril smudges will not be points. They can see it, touch it and have a general idea of how it would behave as an investment in these circumstances. Other than this, you should buy silver if you can not afford to buy gold. JULIE: Many gold enthusiasts still remember the 1970s, a trifecta of recession, double-digit inflation and soaring oil prices.

If you have any concerns relating to where and ways to make use of gold price, you can contact us at our web site.

- 이전글Injury Compensation 101 Your Ultimate Guide For Beginners 25.01.06

- 다음글It's the Side Of Extreme What Was The Date 14 Weeks Ago Rarely Seen, But That's Why Is Needed 25.01.06

댓글목록

등록된 댓글이 없습니다.